Venture Growth Fund

The Victorian Government is providing $25 million in funding to establish the Venture Growth Fund (VGF). This fund will offer eligible high-growth startups access to venture credit of between $50,000 and $5 million, helping create jobs and driving economic growth. The VGF is part of the Victorian Government 2020-21 State Budget.

The objectives of the VGF include:

- increasing the level of investment in start-ups.

- upskilling the workforce in Victoria.

- developing new industries; and

- supporting job creation and economic growth.

What is venture credit?

Venture credit is a relatively new asset class in Australia but has shown great success in some capital markets overseas. In the United States and Europe, venture credit represents about 10 to 15 per cent of total venture funding.

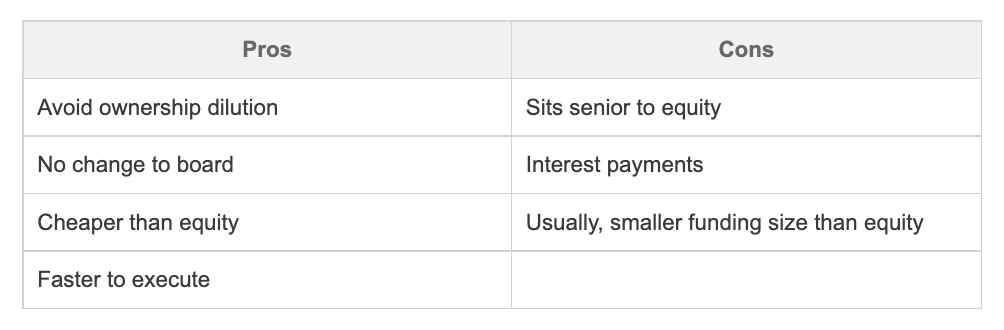

Venture credits allow startups to take on debt to fund their company, rather than giving away equity in exchange for capital to extend their cash runway. Unlike conventional debt financing methods, venture credit lenders do not assess the loan based on underlying assets but instead take a holistic assessment of the company and its future potential.

Fund managers

The Victorian Government has appointed OneVentures and Lighter Capital to manage and deliver the VGF. Both managers will be responsible for managing the assets of the fund and making all the investment decisions.

OneVentures has been allocated $15 million of the VGF funding. The Victorian Government’s investment has been matched by $15 million of private capital. Lighter Capital has been allocated $10 million of mezzanine capital, which has been matched by $20 million of private senior capital. Sitting behind the debt investors will be equity capital provided by Lighter Capital.

The fund managers will have strong audit, risk, economic impact, and compliance reporting requirements. All VGF loans will need to meet the Victorian Government’s Environmental, Social and Governance (ESG) governance policies.

About OneVentures

OneVentures is one of Australia’s largest venture capital firms with around $600 million in funds under management across five funds and 17 co-investment funds.

In 2018, OneVentures launched a partnership with Viola Group, Israel’s largest technology investment group, to bring venture credit to Australia. Viola supports OneVentures in deal screening, structuring, investment decision making and portfolio company reviews.

It is expected that the VGF will make loans of between $0.5 million and $5 million on a six to 48 months term (the size may vary depending on the fund manager’s parameters) and charge interest rates that reflect the relatively high-risk nature of startup investments. Loans will be typically covenant light and will not require personal director guarantees. Funding may be tied to milestones with part of the funds advanced upfront and further funds as the business develops so they are not over-geared at any time.

Contact OneVentures to learn more about the 1V VGF Credit Fund.

About Lighter Capital

Founded in Seattle, USA in 2009, Lighter Capital is the pioneer and leader in revenue-based financing for early-stage technology companies. Since inception, it has provided over USD$200 million in non-dilutive growth funding to more than 400 companies.

Major equity investors in Lighter Capital are US venture capital firm Voyager Capital, Silicon Valley Bank (the largest global venture debt provider), and the National Australia Bank (NAB).

Lighter Capital’s core product is the revenue-based loan, which combines flexible repayments based on the business’ revenues with dilution-free and covenant-light terms. This type of loan is attractive to early-stage start-ups who want the flexibility of repaying only when they get paid and want to maintain maximum ownership and control of their businesses.

It is expected that Lighter Capital will make loans of between $50,000 and $2 million, and will not require equity, warrants, board seats, or financial covenants. The typical company Lighter Capital expects to deal with will be revenue generating companies generating over $15,000 monthly recurring revenue that are typically bootstrapped or are between Seed and Series A.

Contact Lighter Capital to learn more about the Lighter Capital Fund.